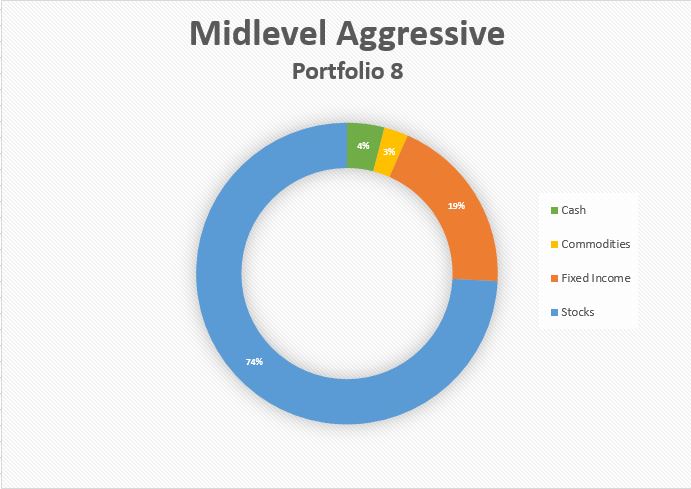

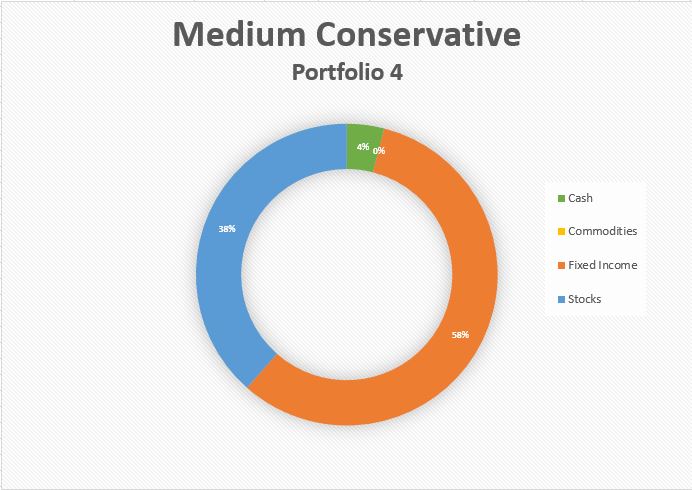

Cash: Cash can be cash in the bank, certificates of deposit, currency, money market holdings, fixed-income securities that mature in less than 12 months, commercial paper and repurchase agreements. While investing in cash or cash equivalents is generally considered to be a safe investment, it is still subject to inflation risk; the risk that inflation will outpace the performance on your investment as inflation shrinks the purchasing power of your cash investment.

Commodity: A generic term for any item or product that can be traded by investors on a market. More specifically, it refers to natural materials and their derived products such as metals, agricultural products and energy products. Investing in commodities or equity securities of commodity-related companies may have greater volatility than investments in traditional securities. The commodities market may fluctuate widely and the value of the investment can experience periods of significant movements up and down.

Fixed Income: Money that is invested in bonds, certificates of deposit, etc., that produce a fixed amount of interest income over a given period and then return the investor’s principal.

Stocks: Also known as equities, stocks represent a share of ownership in a publically held company. Investing in stocks may have greater volatility than investment in fixed income. Upon redemption, the shares of stock may be worth more or less than the original purchase price. Return on investment and return on principal is not guaranteed.